All

Acreage

Adobe

Albuquerque Journal

Albuquerque Museum

Annex General Contracting

Appeal

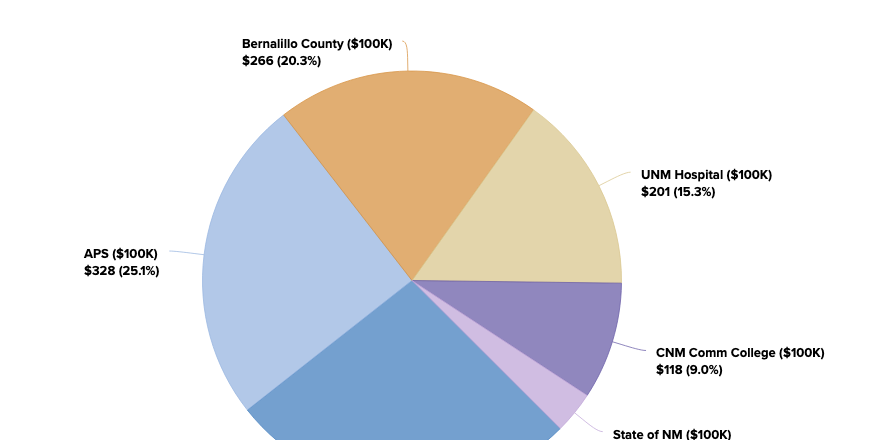

APS

Assessor

Auto Show

Awards

Backyard Access

Bank of Albuquerque

Barn

Basement

Bear Canyon Senior Center

Bed & Breakfast

bed and breakfast

Bernaillo

Bernaillo County

Bernalillo

Bernalillo County

Biking

Bosque

Brick

Bungalow

Buying

Caballero Ranchitos

Casita

Catio

Cedar Crest

Centex Custom

Channing Kelly

Charter Schools

Christmas Tree

Christmas Tree Recycling

City of Albuquerque

Civic Plaza

CNM

Commercial

Community

Community Engagement

Community Swimming Pool

Condo

Contemporary

Coronavirus

Corrales

COVID-19

Craftsman

Desert Ridge

Desert Ridge Trails

Doctor Loan

Downtown

Dream Garage

Drug Take Back

Earth Day

East Mountains

Electronics Recycling

Energy Saving

Fannie Mae

Far North Valley

Federal Reserve

Fixer Upper

FlexMLS

Food Fridays

Foothills

Foreclosure

Four

Four Hills

GAAR

GAAR Good Neighbor Award

GAAR Grande Open House

Gated

Gated Community

Glenwood Hills

Golf Course

Greater Albuquerque Association of Realtors

Growers Markets

Guest House

Guest Quarters

Habitat for Humanity

Harder Homes

Hardwood

Hardwood Floors

Hazardous Waste

High Desert

Hiking

Historic Character

Home Office

HomePath

Horse Property

HVAC

In-Laws Quarters

In-Slab Ducts

Inman

Inspection

Interest Rates

Juan Tabo Hills

Kirtland Air Force Base

Kris Cannaday

La Cueva

La Luz

La Montanita Co-Op Earthfest

Ladera

Land

Large Yard

Lights

Living Cities

Local

Loft

Los Ranchos de Albuquerque

Lumber Liquidators

Maxwell Homes

Medical Professional Loan

Mid-Century Modern

MLS

Modern

Morgan

Morgan Cannaday-Henson

Moriarty

Morningside Park

Mossman

Mountains

NE Heights

Near North Valley

Neighborhood Toy Store Day

New Construction

New Mexico Appleseed

New Mexico Kids Matter

Nob Hill

North Albuquerque Acres

North Star

North Valley

Northern New Mexico

notice of value

Open House

Out of the Blue Toys

Paint

Palomas Park

Parade of Playhouses

Park Plaza

Pay Taxes

Phoenix

Placitas

PNM

Portal

Price Reduced

Primrose Pointe

Prive Improvement

Property Tax

Property Taxes

Protest

Public School

Pueblo Style

Rail Yards Market

Ranch

Ray Lee Homes

Recycling

Refinancing

Refrigerated AC

Remodeled

Rental

Ridgecrest

Rio Rancho

Route 66

RV Parking

Sandia Heights

Sandia Labs

Sandoval County

scam

School Choice

School Choice Fair

Schools

Search

Sears Outlet

Shredding

Single Level

Skylights

Solar

Sonotube

South Valley

Southwest Contemporary

Spurlock

Stain

Stillbrook Homes

Storage

Studio

Stuff the Truck

Summit Hills

Summit Park

Swimming Pool

Tanoan

Tanoan East

Tax

Tax Exemptions

Tierra Monte

Tijeras

Tour

Town Home

Town Park

Twin Parks

Two Master Suites

Universal Design

UNM

Updated

Uptown

Urban

Valencia County

Views

Vineyard Estates

Vista Del Rey

Volterra

Vote

Watson

Weekend Picks

West Downtown

Workshop